Structure

A smarter approach to Loan and Asset Management

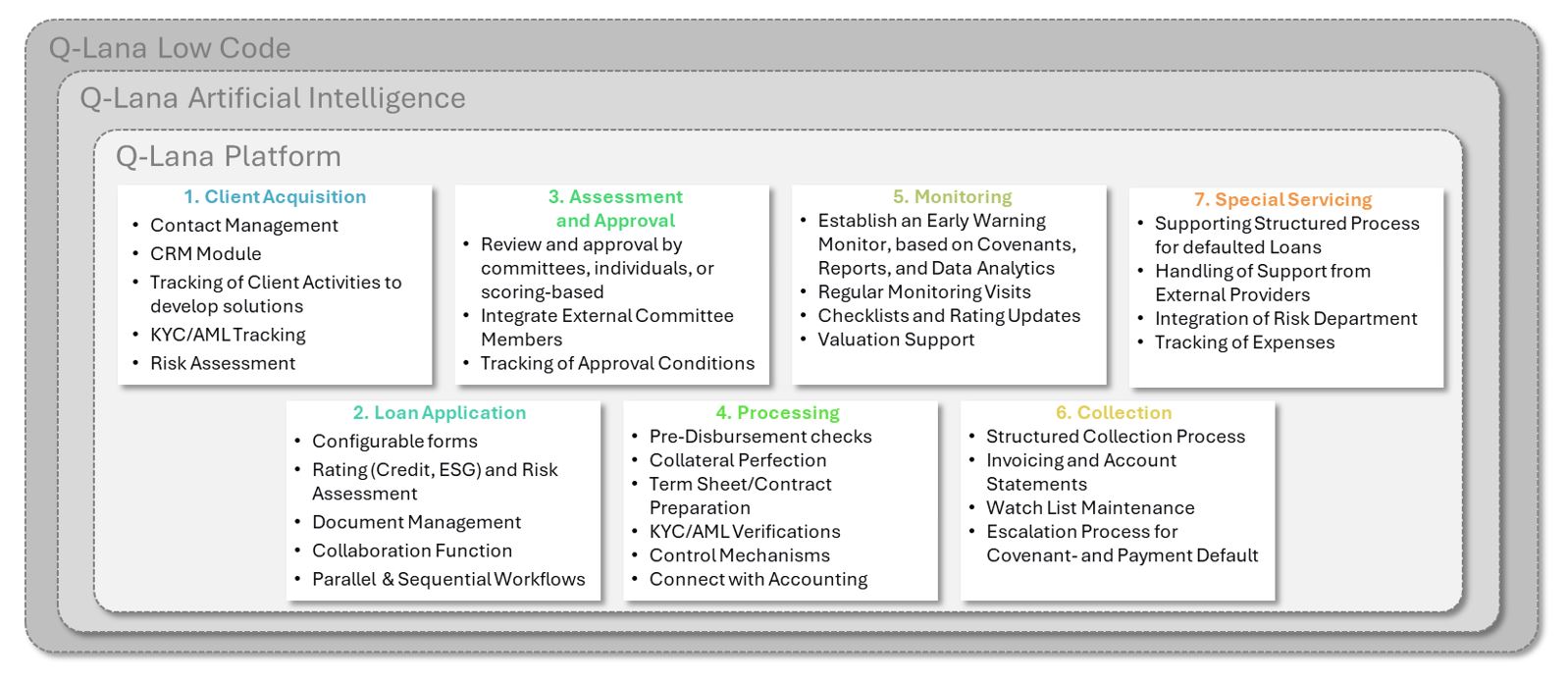

Q-Lana’s Loan and Asset Management Platform is a comprehensive solution designed to handle various asset types like loans, equity investments, convertibles, and guarantees.

It splits the lending/investment process in seven phases: Client Acquisition, Loan Application, Assessment and Approval, Processing, Monitoring, Collection, and Special Servicing.

The platform adapts to specific workflows, integrating smart solutions from extensive finance and risk management experience. It structures loan applications into modules, uses scoring tools for in-depth analysis and monitoring, and integrates ESG risk assessments. Q-Lana maintains high data quality with ongoing updates and built-in checks.

Q-Lana’s workflows explained

Now, we are taking things further.

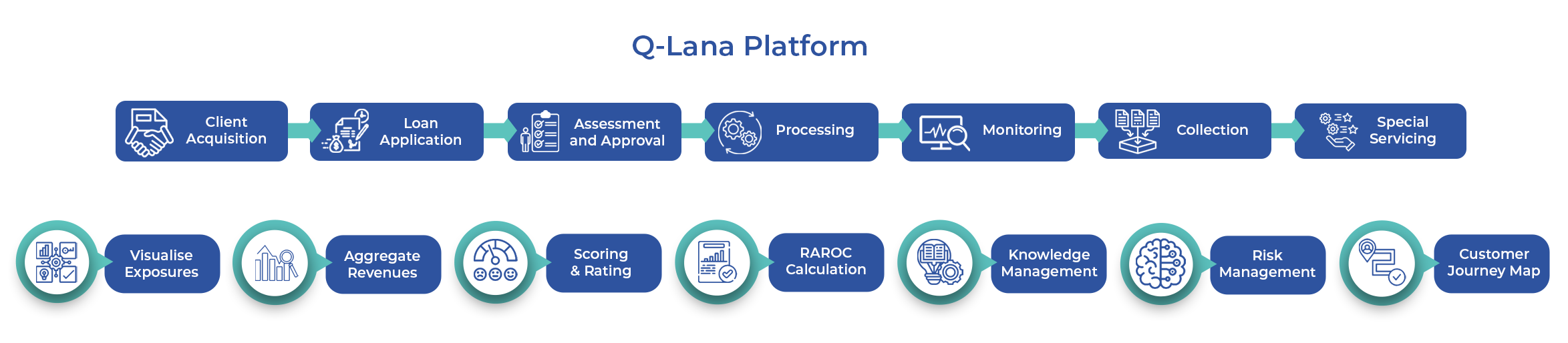

Transforming the Loan and Asset Management platform into a powerful steering instrument for financial institutions and asset managers.

Our platform is prepared to visualize exposures across client groups, aggregate revenues and continuously assess the risk profile. Q-Lana combines the information to calculate a Risk Adjusted Return on Capital which will align risk appetite with actual business activities.

This makes Q-Lana the place where concepts and reality converge. Q-Lana becomes the central hub for knowledge management, combining your institution’s data with state-of-the-art risk management practices.

How we approach Risk Management

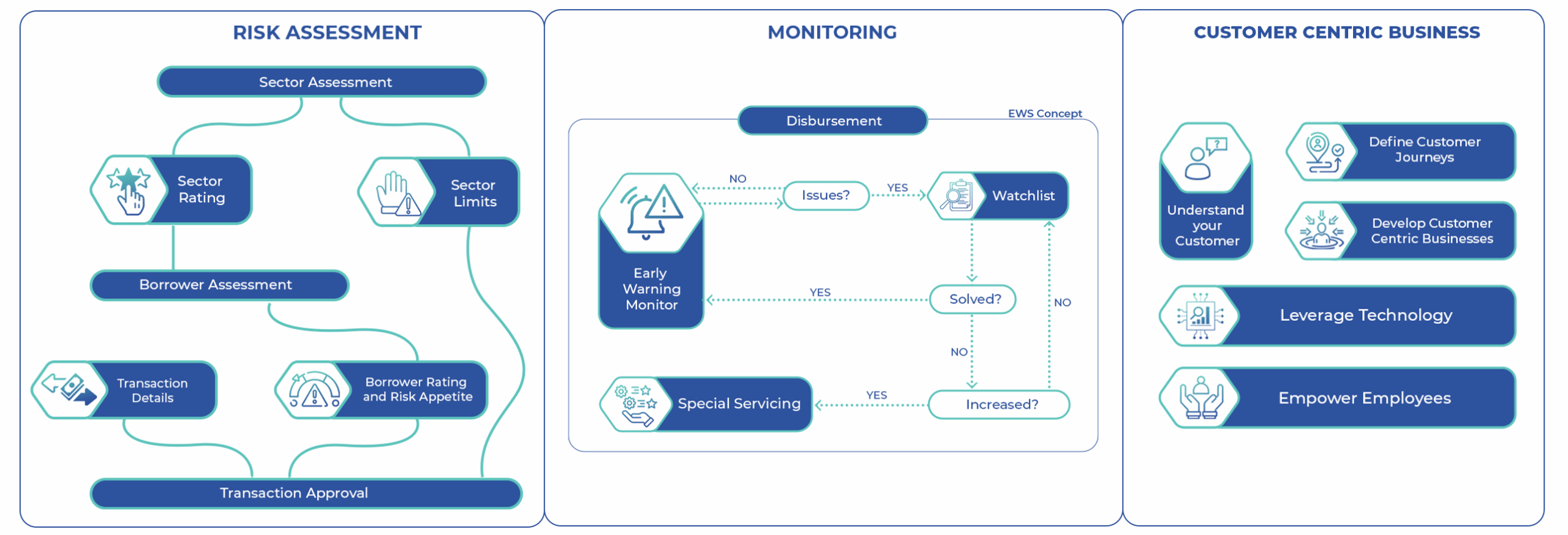

At Q-Lana, we’ve implemented advanced loan management processes to enhance risk assessment and monitoring. Our “Knowledge-Based Lending” approach leverages data collected in smart and structured ways, blending qualitative and quantitative insights for better decision making.

In risk assessment, Q-Lana offers a structured methodology, defining risk appetite and creating a flexible limit system. It integrates qualitative and quantitative metrics, providing a comprehensive risk view. This adaptability helps institutions balance risk with market dynamics.

Q-Lana’s Early Warning System and other analysis tools monitor internal and external indicators, flagging potential risks early. Q-Lana actively manages waivers and amendments, guiding users through structured processes to minimize losses and maintain client relationships.

For customer-centric business, Q-Lana aggregates customer data, linking it to sector trends. This strategy refines customer journeys and addresses broader financial needs, enhancing client loyalty and business growth.

If you’re interested to learn more, we invite you to get in touch.