Expert Advisory Services

We help you make informed decisions with confidence, and implement solutions that drive real impact.

Practical Solutions, Lasting Impact

Our team brings over 35 years of experience in financial institutions, fund management, and industry associations.

We have guided more than 100 clients through challenges in risk management, SME lending, portfolio oversight, product development, and digital transformation, all while prioritizing each client’s unique goals.

Our Approach

What sets us apart is our blend of advisory expertise and technology. This synergy delivers results quickly and consistently, without unnecessary frills or endless slide decks.

We focus on forging long-term partnerships built on trust, taking pride in our work and refusing to settle until a useful solution is found.

Building Lasting Relationships

We see every advisory project as a stepping stone toward a deeper relationship, one that allows clients to experience our commitment and test our capabilities firsthand. For us, it’s not about glossy presentations; it’s about delivering tangible improvements and lasting value. We look forward to earning your confidence as we help strengthen your organization’s operations and risk profile.

Sample Projects

How our Advisory Service can support you

Implemented Risk Management Frameworks: Conducted comprehensive assessments, developed policies and governance structures, enhanced reporting processes, fostered risk culture, and ensured regulatory compliance for financial institutions in the Middle East, Eastern Europe, Asia, and Africa.

Developed a Risk Appetite Strategy: Utilized advanced risk modeling and tailored portfolio strategies, taking into account institution-specific conditions for a pragmatic and effective approach.

Established Internal Risk Reporting and Key Risk Indicators: Designed and implemented advanced loan portfolio analysis and stress testing capabilities for large MFIs in Asia, Africa, and the Middle East.

Led Restructuring and Turnaround Planning: Provided strategic and operational support, including negotiation with institutional lenders, to guide a financial institution through critical transition periods.

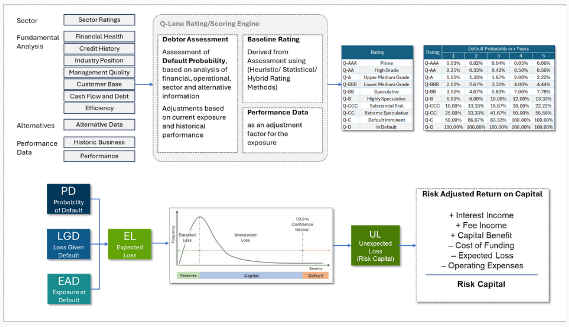

Implemented Basel II/III-Compliant Risk Management: Introduced ICAAP reporting, developed statistically driven scoring models, and integrated best practices for regulatory alignment.

Formulated Bad Debt Collection Strategies: Addressed post-crisis scenarios with targeted approaches to reduce non-performing exposures and recover capital efficiently.

Developed Financial Models and Operating Procedures: Created frameworks for financial institutions and investment funds, covering transaction sourcing, assessment, approval, monitoring, collection, and reporting structures.

Drove Digital Transformation: Shaped and executed modernization initiatives to enhance risk management functions and improve customer experience in alignment with organizational goals

Reach out for our Advisory Support

Discover how our personalized approach can elevate your financial institution.

Contact us today to start creating solutions that are truly impactful, practical, and uniquely tailored to your needs.