Analysis Tools

Manage risks and develop customer-centric solutions

At Q-Lana, our loan and asset management platform serves as the flexible core that adapts to your institution’s evolving needs. Alongside this comprehensive platform, we also offer a suite of stand-alone tools designed to help you effectively manage risks and create customer-centric solutions.

Understanding how this works

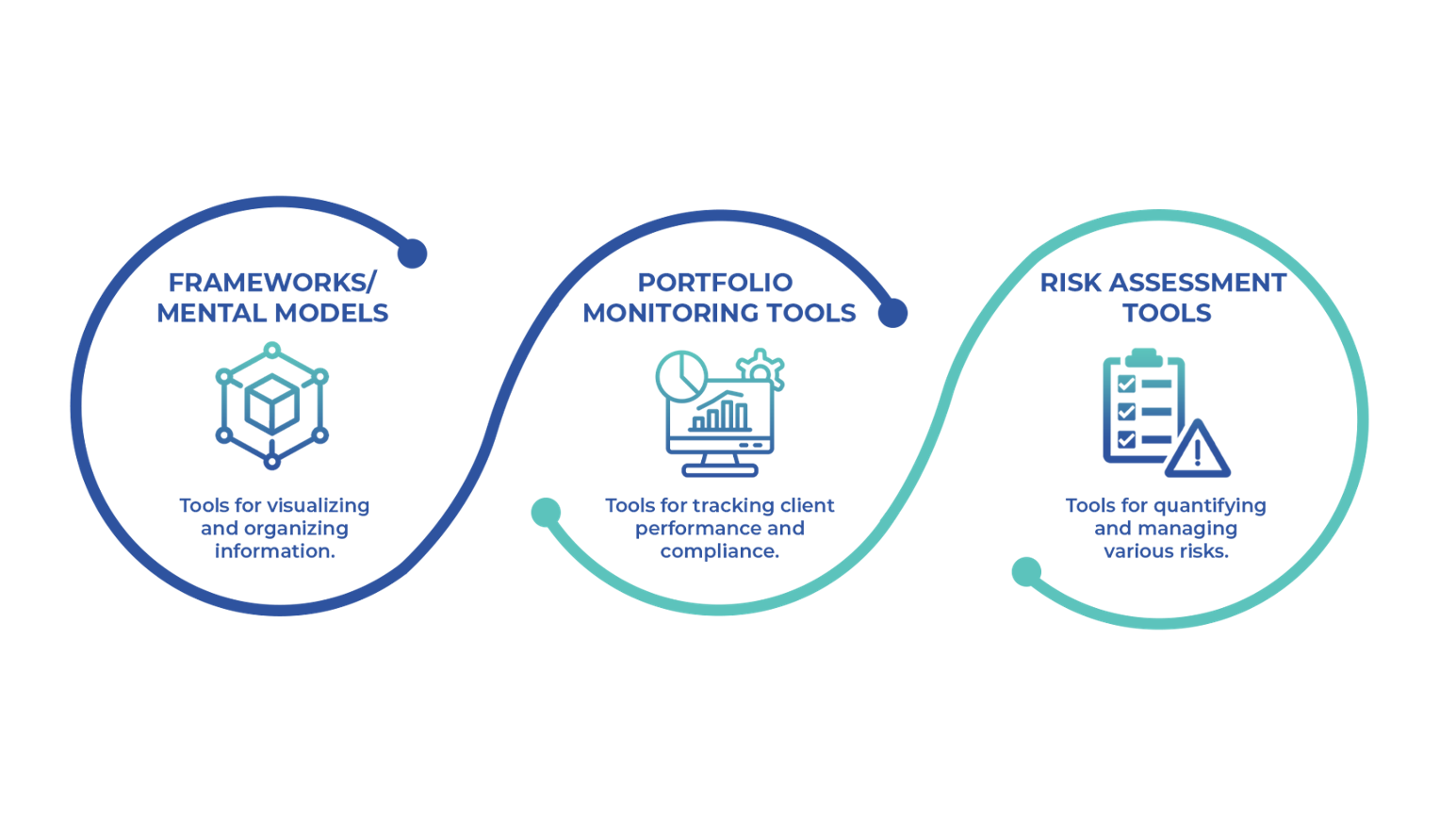

We bring together three key groups of analytical tools to support you and your clients.

Risk Assessment

Tools

Risk Assessment Tools

Our risk assessment tools help you in the quantification of all types of risk, including credit, market, and operational risk. These tools often integrate or build on each other.

You can combine Q-Lana’s Credit Rating/Scoring Tool with the calculation of a Probability of Default. The results then feed into the Valuation and the calculation of the Risk-Adjusted Return on Capital, which can be used to define Risk Appetite.

Portfolio Monitoring Tools

Portfolio monitoring tools gather information from the monitoring activities and track clients’ performance regarding covenant compliance and debt service payments.

For example, tools like Vintage Analysis and Migration Tables integrate into Q-Lana and receive information from Financial Service Providers over time.

Portifolio

Monitoring

Tools

Models

Mental Models

Mental models visualize ideas and concepts, offering a systematic way to capture and organize information. They help users understand concepts by breaking them down into their parts, leading to a better understanding and organization of existing information.

Q-Lana integrates tools like SWOT Analysis, Porter’s 5 Forces Model, and the Business Canvas to help users better understand their customers.

The Q-Lana team is continuously working on new tools and upgrades to existing tools. We are keen to work with our clients also in co-development to support them with the necessary analytics to improve their operations in all dimensions.