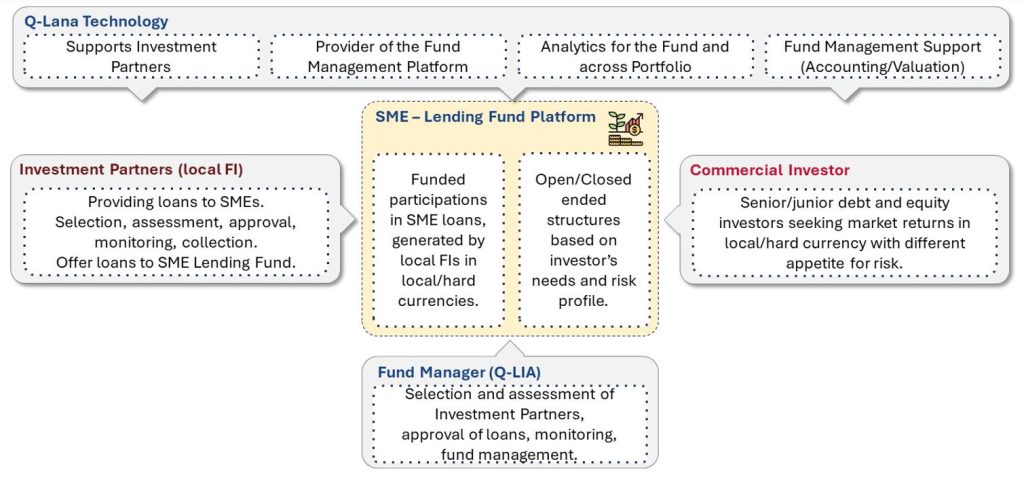

SME Lending Fund Platform

Combining skills, customer focus and risk capital

Empowering SME growth with Smarter Lending Solutions.

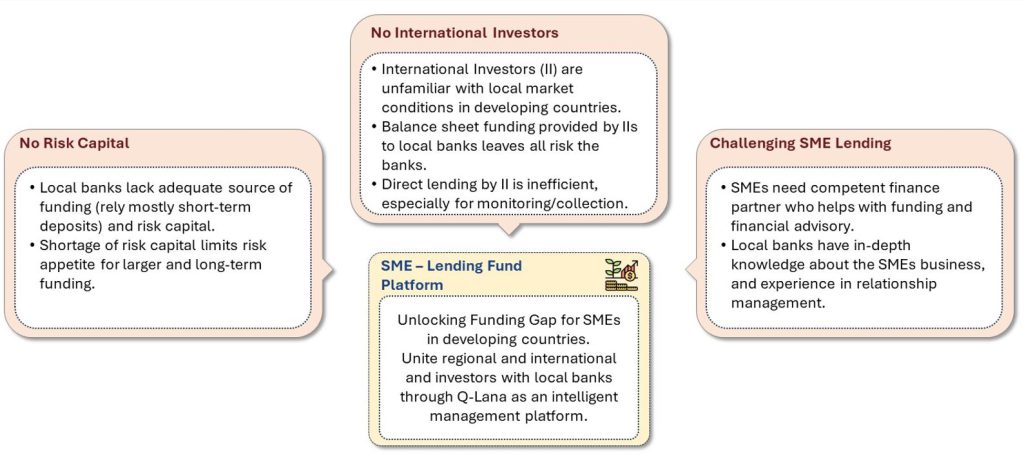

Q-Lana introduces the SME Lending Fund Platform, designed to address the unique challenges of SME lending by harnessing the strengths of local banks and investors. This innovative platform combines the deep expertise of local financial institutions with the resources of investors to create a powerful solution for SME financing.

- Local financial institutions are key partners for SMEs, offering funding and financial advisory services. However, limited risk capital often constrains their support.

- The SME Lending Fund Platform addresses this with a risk-sharing mechanism. This allows the Fund and investors to take on default risks, reducing regulatory burdens for local banks and aiding term funding.

- Investors benefit from direct access to credit risk via loan participations from local institutions. This structure aligns the interests of banks and investors, promoting collaboration in loan monitoring and collections.

- The Fund will launch multiple funding vehicles to meet varied investor and bank needs, adapting to market conditions and investment strategies.